On 29th September 2025, the UAE Ministry of Finance took a big step forward in reshaping how businesses handle tax compliance. Two new decisions were issued:

- Ministerial Decision No. 243 of 2025, which sets out the rules, scope, definitions, and obligations of the new system.

- Ministerial Decision No. 244 of 2025, which provides the phased rollout plan, timelines, and compliance requirements.

Together, these decisions introduce the Electronic Invoicing System (EIS) – a central, government-run platform designed to move businesses away from manual or paper-based VAT invoicing, and toward structured, digital records that are fast, transparent, and secure.

For businesses, this is not just another compliance requirement. It’s part of a wider transformation toward digitization, transparency, and efficiency in the UAE economy.

- What is E-Invoicing:

E-invoicing (electronic invoicing) refers to the generation, transmission, receipt, and storage of invoices (and related documents like credit/debit notes) in a structured electronic format, using defined standards so that the documents can be automatically processed by computer systems.

- Scope of Application:

Applies to:

- All businesses conduct transactions in the UAE, unless excluded under Article 4 of ministerial decision no. 243 of 2025.

- Any additional persons or transactions determined by the Minister

Exclusions:

Excluded Transactions:

- Government activities in sovereign capacity.

- International passenger transport (with electronic ticket).

- Airline ancillary services with electronic miscellaneous documents.

- International goods transport by air (for 24 months after system launch).

- Exempt or zero-rated financial services.

- Others as determined by the Minister.

- Business-to-Consumer Transactions (B2C): Not subject to the EIS until a later date determined by the Minister.

Excluded Persons:

- To be specified separately by ministerial decision.

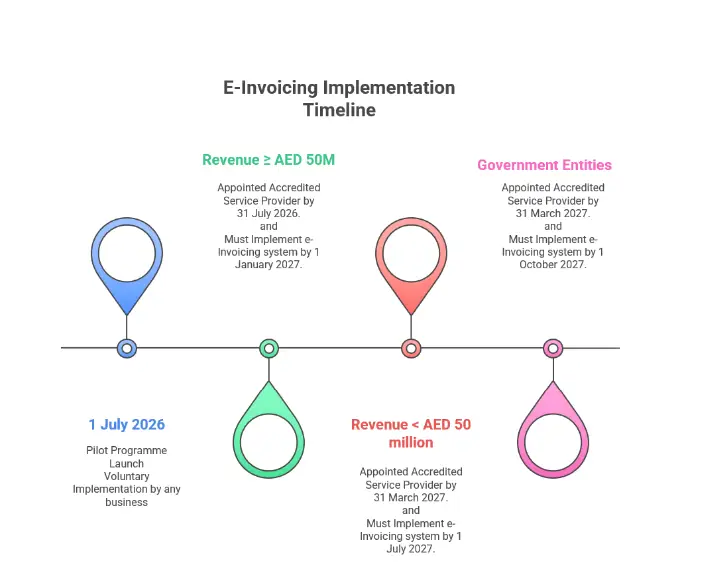

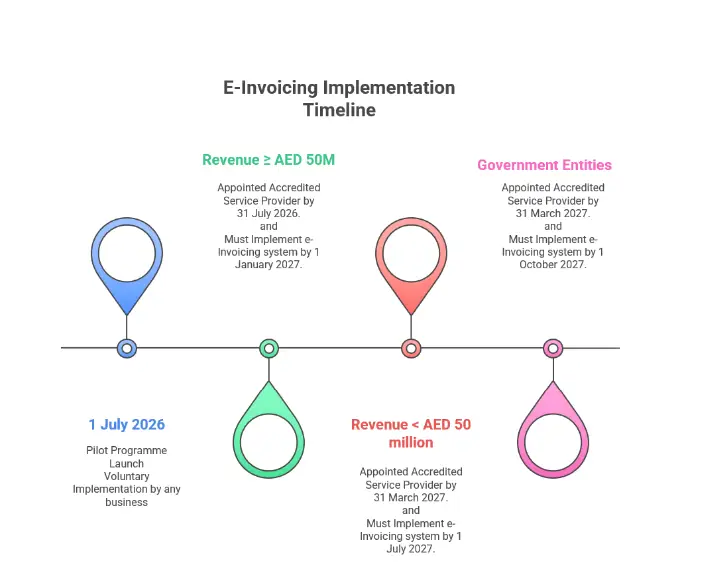

- Implementation Phases Timeline:

The UAE government has mandated the phased implementation of a new Electronic Invoicing System. All businesses must comply by appointing an Accredited Service Provider and integrating the system according to the deadlines below.

Phase 1 – Pilot Programme

Phase 1 – Pilot Programme

- Launch date: 1 July 2026.

- Participants: A select group of businesses forming the “Taxpayer Working Group.”

- Purpose: To test the system, fix issues, and fine-tune before mass adoption.

Phase 2 – Voluntary Adoption

- Starting 1 July 2026, any business can voluntarily adopt the system if they are ready

Phase 3 – Mandatory Adoption

Deadlines depend on business size and type:

| Revenue |

Appointed Accredited Service Provider by |

Implementing the E Invoicing System |

| Revenue ≥ AED 50M |

31 July 2026 |

1 January 2027 |

| Revenue < AED 50M |

31 March 2027 |

1 July 2027 |

| Government Entities |

31 March 2027 |

1 October 2027 |

The gross income earned by a Person during the most recent Accounting Period, based on the financial statements prepared in accordance with applicable legislation in the State or, if such financial statements are not available, based on other documentation acceptable to the Authority.

B2C Transactions: Not subject to the EIS until a later date determined by the Minister.

4. Applicability and Administrative Penalties:

Both decisions came into force immediately after being published in the Official Gazette.

- Any earlier rules that contradict them are repealed.

- Penalties for non-compliance will follow the existing UAE VAT and Tax Procedures Law framework. This means businesses could face fines for failing to issue e-invoices, late reporting.

- Roles and Responsibilities:

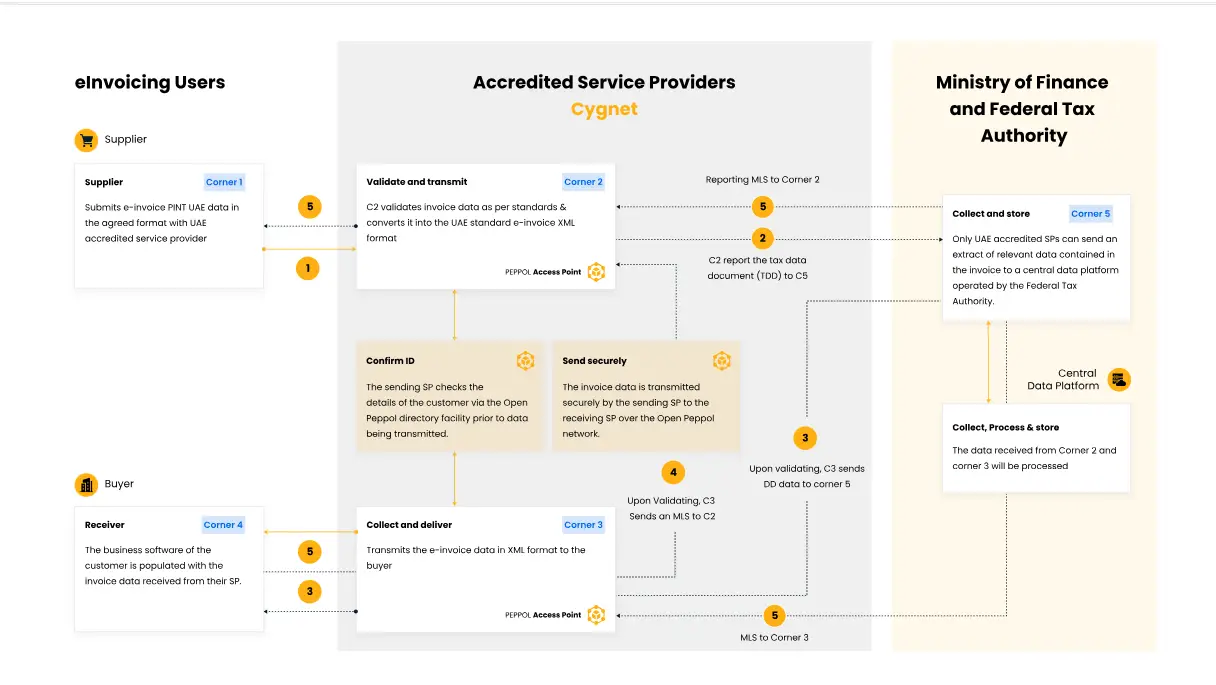

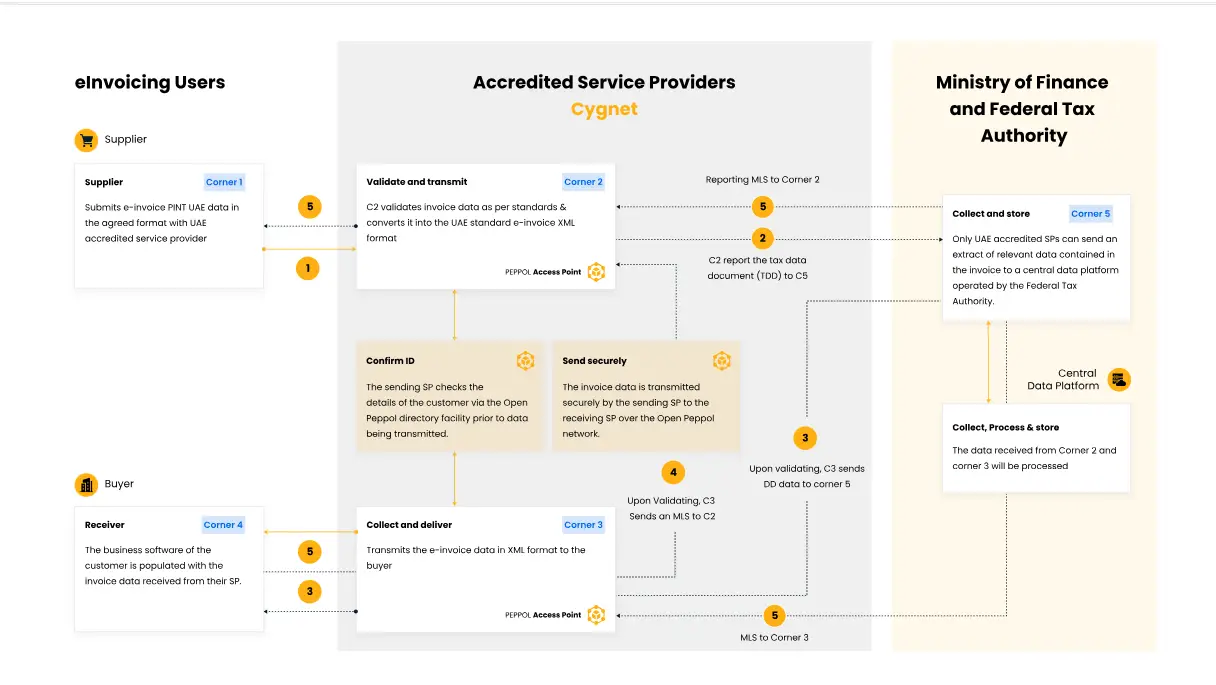

E-Invoicing Users /Accredited Service Providers /Ministry of Finance and Federal Tax Authority

- How RMC can help businesses to Successfully Implement the same:

RNG provides end-to-end e-Invoicing readiness and implementation services, ensuring your full compliance with UAE’s regulatory framework.

Our services include:

- Assessing your turnover eligibility and compliance phase under the FTA roadmap.

- Appointment process and guiding of ASP

- Assisting with integration of your accounting/ERP software with the ASP system.

- Conducting data validation, pilot testing, and readiness assessments.

- Providing staff training on e-Invoicing issuance, reporting, and archiving.

- Offering ongoing compliance monitoring to avoid penalties or rejections by the FTA.

We ensure that your business not only complies but also benefits from automation, efficiency, and better financial control under the new e-Invoicing ecosystem.

Phase 1 – Pilot Programme

Phase 1 – Pilot Programme