(Date 01-8-2025 Version 1.0.0.0)

The Federal Tax Authority (FTA) offers registered taxpayers a secure and user-friendly platform—EmaraTax—to facilitate the payment of UAE Corporate Tax. Below is a simplified process to help companies navigate through the portal efficiently and make payments on time.

This manual is prepared to help a registered Corporate Taxpayer to navigate through the Federal Tax Authority EmaraTax portal and make their Corporate Tax Payments.

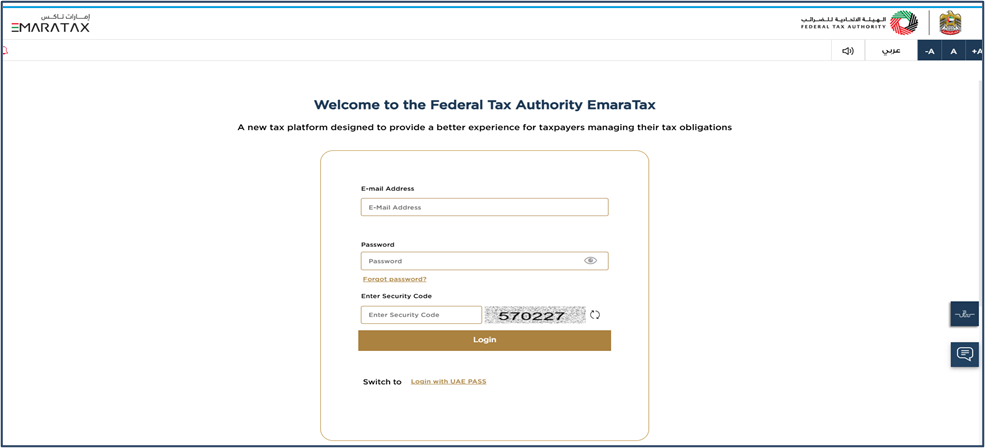

Step 1: Login to EmaraTax

Step 2: Access Your Dashboard

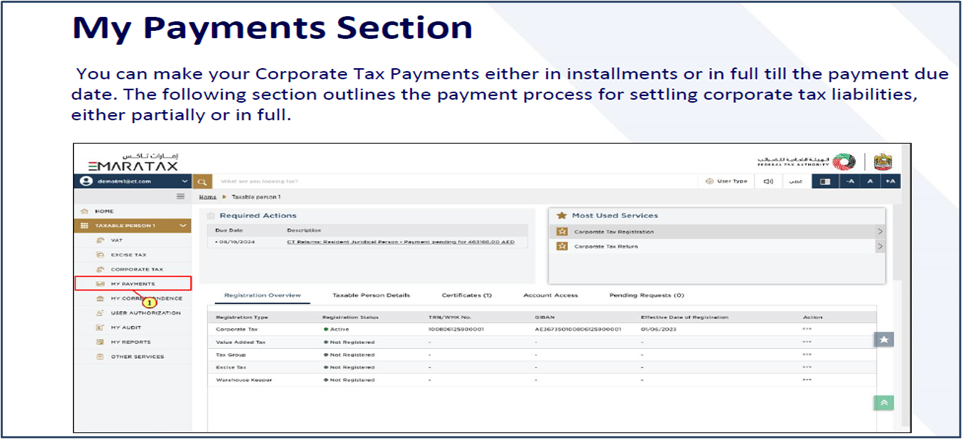

Step 3: Go to “My Payments” Section

On the dashboard, click on “My Payments”. Here you can view:

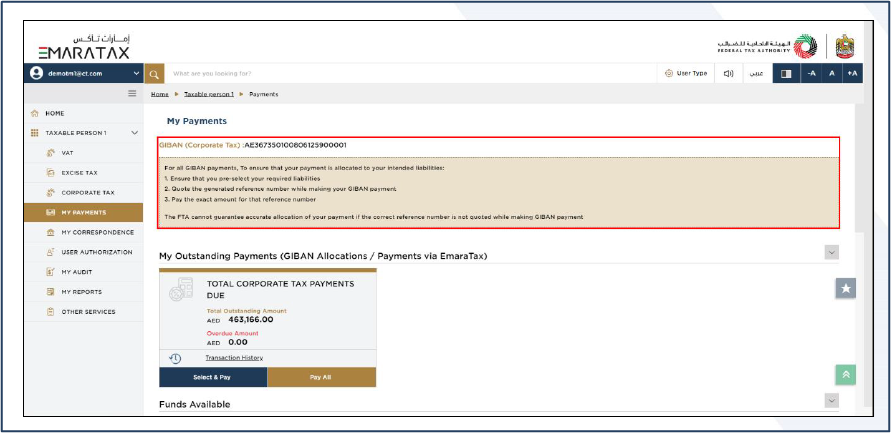

Step 4: Select Your Payment Option

Step 5: View Pending Payments

Step 6: Choose a Payment Method

You have two options for making payments:

A. Card Payment via Magnati Pay

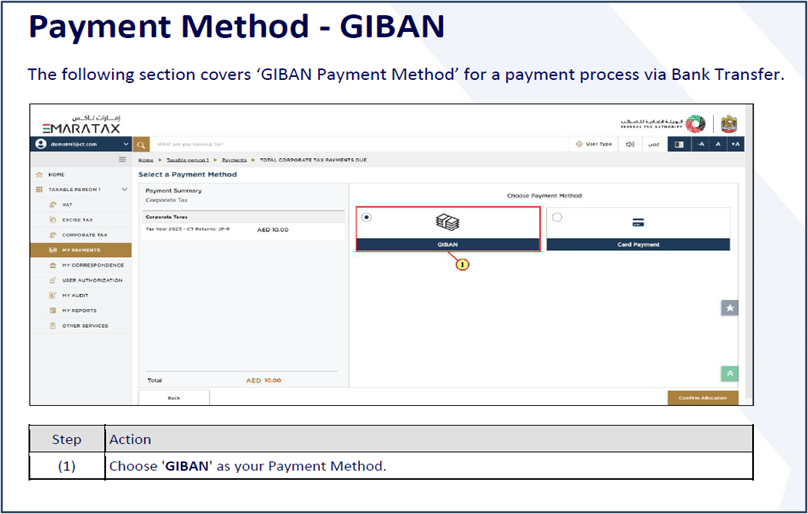

B . GIBAN (Bank Transfer)

B . GIBAN (Bank Transfer)

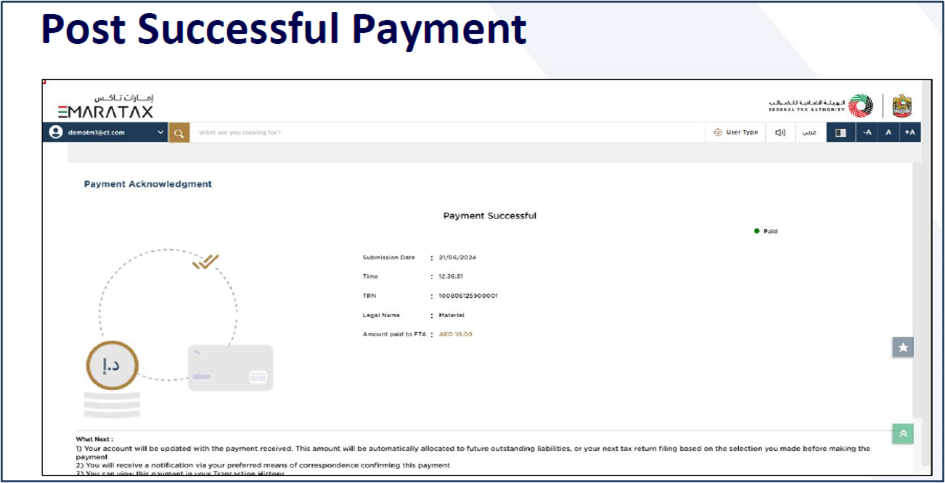

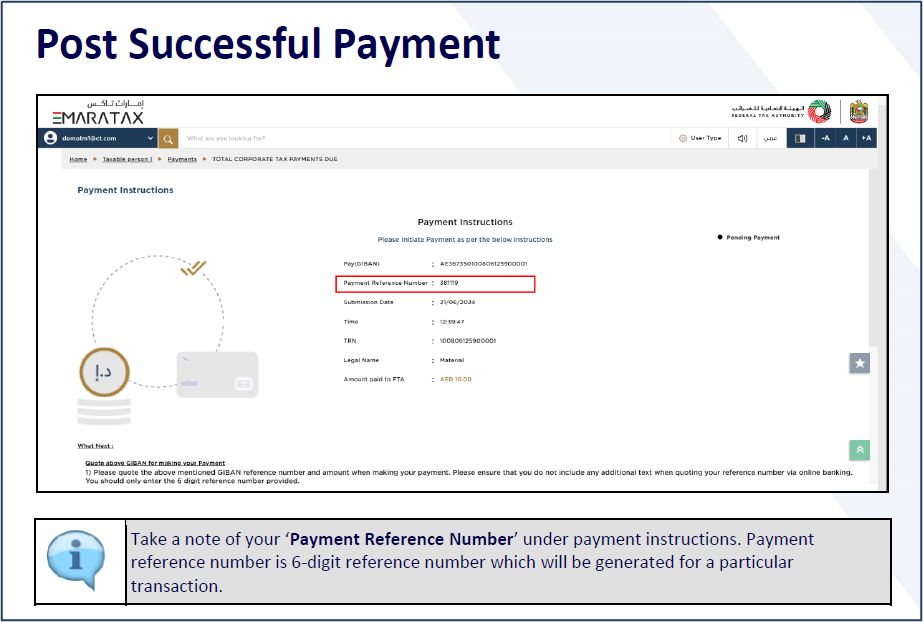

Step 7: Post-Payment Acknowledgement

Step 8: Allocation of Payments

Schedule Your Consultation. Trusted audit Services in UAE.

Sharjah :

SAIF Zone, Q1-08-096/B,

Sharjah – U.A.E

Copyright © 2026 All Rights Reserved RNG Auditors LLC